Angel One APIBridge

Get India’s Genuine APIBridgeTM in Production Since 2018

Don’t just trade. Api-bridge your trading to maximize profits and minimize risks.

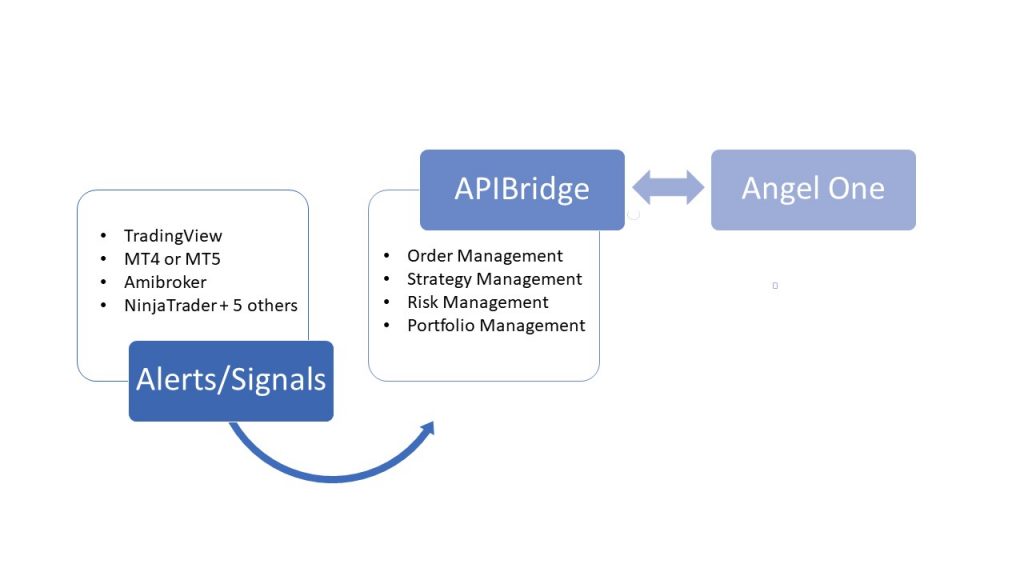

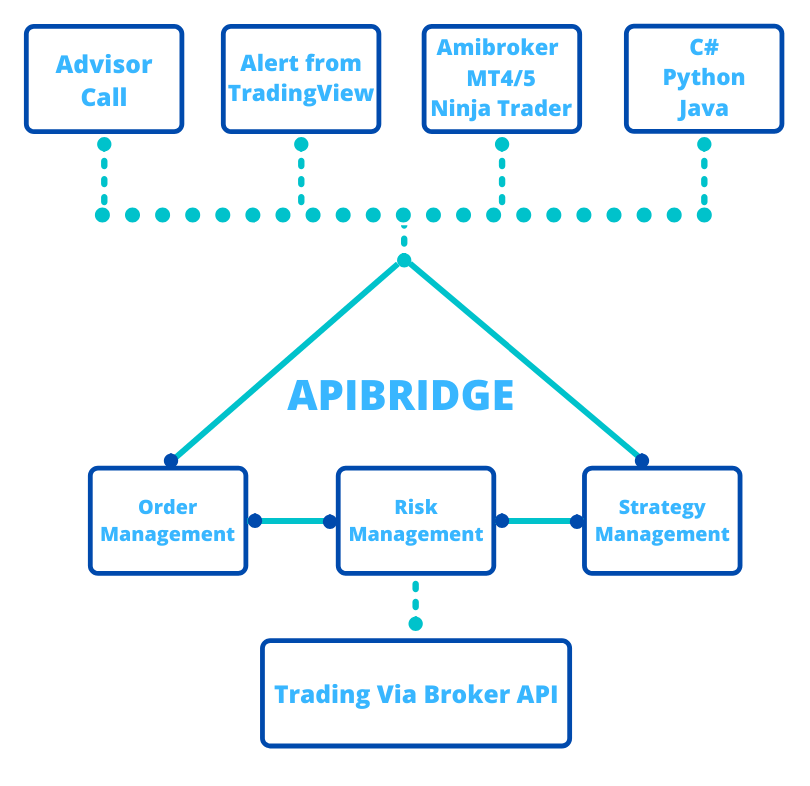

APIBridge enables your trading with intelligence for strategy management, order management, risk management and portfolio management. APIBridge is the only application which truly protects the privacy of your trading strategies. See documentation here.

>> Reduce your trading costs as much as 0.1% for each order

>> Trade from Multiple-Strategies in Multiple-markets

>> Trade via your favorite advisor, or top strategy platforms like TradingView, Amibroker, MetaTrader, Excel-VBA etc.

>> Trade using charts or via screener for 100s of stocks

Benefits of Trading with APIBridge

While conventional trading platforms work based on only buy and sell; APIBridge work on 4 types of Signals:

Long Entry (LE): Equivalent to fresh Buy for creating Long position

Long Exit (LX): Equivalent to Sell for reducing/squareoff Long position

Short Entry (SE): Equivalent to fresh Sell for creating Short position

Short Exit (SX): Equivalent to Buy for reducing/squareoff Short position

For placing orders, APIBridge requires values either from Signal, or from your settings.

API Bridge is intelligent application and it give you full control to decide:

>> Your choice of Scrip list

>> Order Quantity, Order Type and Product Type

>> Partial exit levels; both scale-in and scale-out

>> Maximum profit/loss per trade, per strategy, or per day

Leverage TradingView Community

API Bridge allow easy integration with TradingView.com

Trade using 1000s of strategies reviewed and tested by TradingView community. See documentation here. You can deploy algos based on:

(a) Indicators such as SuperTrend, RSI, MACD etc,

(b) Price patterns like Open Range Breakout, Highs and Lows, Trendlines etc.

(c) Multi-leg execution such as straddle, strangle or butterfly.

(d) Your custom, backtested pinescript strategies

Get India’s Genuine APIBridgeTM in Production Since 2018